Understanding the complexities of government assistance programs can be daunting, especially when it comes to determining how different sources of income are counted. One common question that arises is whether Section 8, a federal housing assistance program, considers food stamps as income.

In this article, we will delve into the details of Section 8, the Food Stamp Program, and how food stamp benefits impact Section 8 eligibility, providing clarity and guidance to those seeking assistance.

Government assistance programs play a crucial role in supporting low-income households by providing financial aid, housing assistance, and nutritional support. Understanding the eligibility criteria and income calculation rules for these programs is essential to maximize their benefits while ensuring compliance with program regulations.

Government Assistance Programs

Government assistance programs are designed to provide financial and other support to low-income individuals and families. These programs can help people meet basic needs such as food, housing, and healthcare.

There are many different types of government assistance programs, each with its own eligibility requirements. Some of the most common programs include:

- Supplemental Nutrition Assistance Program (SNAP): SNAP, formerly known as food stamps, provides monthly benefits to low-income individuals and families to help them purchase food.

- Temporary Assistance for Needy Families (TANF): TANF provides temporary cash assistance to low-income families with children.

- Medicaid: Medicaid is a health insurance program for low-income individuals and families.

- Supplemental Security Income (SSI): SSI provides monthly cash benefits to low-income individuals who are disabled, blind, or over the age of 65.

Eligibility for government assistance programs varies depending on the program. In general, to be eligible for government assistance, you must be a U.S. citizen or legal resident, have a low income, and meet other specific requirements.

Section 8 Housing Program

The Section 8 Housing Program, administered by the U.S. Department of Housing and Urban Development (HUD), provides rental assistance to low-income families and individuals. It is designed to help participants afford safe and sanitary housing by providing subsidies that cover a portion of their rent.

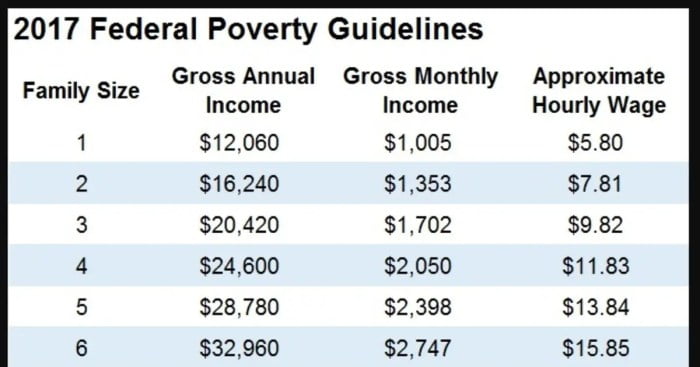

The program operates through local Public Housing Authorities (PHAs), which determine eligibility and administer the program within their jurisdictions. To qualify, applicants must meet income limits set by HUD, which vary based on family size and location. They must also pass a background check and demonstrate a need for assistance.

How the Section 8 Housing Program Works

Once approved, participants receive a Housing Choice Voucher that they can use to find and rent housing in the private market. The PHA then pays the landlord directly for the difference between the voucher amount and the rent charged by the landlord.

This allows participants to choose housing that meets their needs and preferences, while still receiving financial assistance.

Benefits of the Section 8 Housing Program

The Section 8 Housing Program offers several benefits to participants, including:

- Access to safe and sanitary housing: The program helps participants afford housing that meets minimum standards of health and safety.

- Flexibility: Participants can choose housing that meets their needs and preferences, within the guidelines of the program.

- Stability: The program provides long-term rental assistance, which helps participants maintain stable housing arrangements.

- Financial savings: The program reduces the financial burden of rent, allowing participants to use their income for other essential expenses.

Food Stamp Program

The Food Stamp Program, also known as the Supplemental Nutrition Assistance Program (SNAP), is a federal nutrition assistance program administered by the United States Department of Agriculture (USDA). It provides food assistance to low-income individuals and families to help them purchase nutritious food.The

Food Stamp Program operates through a system of electronic benefits transfer (EBT) cards. Eligible individuals and families receive an EBT card that they can use to purchase food at authorized grocery stores and farmers’ markets. The amount of benefits received is based on the household’s income, size, and certain deductions.

Benefits of the Food Stamp Program

The Food Stamp Program has several benefits for low-income individuals and families:

- Provides access to nutritious food, which can improve overall health and well-being.

- Reduces food insecurity and hunger, which can lead to better educational outcomes and economic stability.

- Supports local economies by increasing food sales at grocery stores and farmers’ markets.

- Reduces healthcare costs associated with food insecurity and malnutrition.

Income Calculation for Section 8

Section 8 housing assistance eligibility is determined based on an applicant’s income. Income calculation considers all sources of income, including wages, self-employment earnings, Social Security benefits, and other government assistance programs.

Counting Food Stamp Benefits as Income

Food stamp benefits, also known as the Supplemental Nutrition Assistance Program (SNAP), are counted as income for Section 8 eligibility. However, only a portion of the food stamp benefits received is considered income. The following formula is used to calculate the countable income from food stamps:

Countable Food Stamp Income = Gross Food Stamp Benefit Amount x 0.3

For example, if an applicant receives $300 in monthly food stamp benefits, the countable income for Section 8 eligibility would be $300 x 0.3 = $90.

Impact of Food Stamp Benefits on Section 8 Eligibility

Food stamp benefits, also known as the Supplemental Nutrition Assistance Program (SNAP), can impact Section 8 eligibility in several ways. Understanding these impacts is crucial for individuals and families seeking affordable housing assistance.One significant aspect is that food stamp benefits are considered as income when determining Section 8 eligibility.

The value of food stamp benefits is added to the applicant’s total household income. This means that receiving food stamps can increase an applicant’s overall income, potentially affecting their eligibility for Section 8 housing.

Strategies for Maximizing Section 8 Eligibility While Receiving Food Stamp Benefits

To maximize Section 8 eligibility while receiving food stamp benefits, consider the following strategies:

-

-*Explore Deductions

Certain deductions can be applied to reduce the countable income used to determine Section 8 eligibility. These deductions include medical expenses, child care costs, and dependent care expenses. Utilizing these deductions can help offset the impact of food stamp benefits on income calculations.

-*Consider Household Size

The size of the household can influence the impact of food stamp benefits on Section 8 eligibility. Food stamp benefits are typically issued based on household size, with larger households receiving higher benefits. By considering the number of individuals in the household, applicants can assess how food stamp benefits will affect their income relative to Section 8 eligibility criteria.

-*Plan for Income Fluctuations

Food stamp benefits can fluctuate over time based on changes in income or household circumstances. It’s important to plan for potential income fluctuations and consider how they might impact Section 8 eligibility. Regular communication with the Section 8 housing authority can help ensure timely adjustments to assistance based on changes in food stamp benefits.

Conclusion

In summary, Section 8 and food stamps are two separate government assistance programs with distinct eligibility criteria. Food stamps are considered income when calculating Section 8 eligibility, but the amount of food stamp benefits received can impact the amount of Section 8 assistance an individual or family qualifies for.

To ensure accurate and fair determinations of Section 8 eligibility, it is crucial for individuals to provide accurate information about their food stamp benefits. Additionally, understanding the interaction between these two programs can help individuals maximize their access to available resources.

Recommendations for Further Research

* A comprehensive study examining the impact of food stamp benefits on Section 8 eligibility rates and housing stability outcomes.

- An analysis of the potential effects of policy changes that alter the treatment of food stamp benefits in Section 8 eligibility calculations.

- A qualitative study exploring the experiences of individuals navigating the intersection of Section 8 and food stamp programs, including challenges and opportunities.

- An investigation into the role of caseworkers and housing authorities in providing clear and accurate information about the interaction between these programs.

Final Conclusion

In conclusion, while food stamp benefits are generally not counted as income for Section 8 eligibility, there are certain exceptions and variations based on individual circumstances. It is important to consult with local housing authorities and carefully review program guidelines to determine how food stamp benefits may affect Section 8 eligibility.

By understanding these nuances, individuals can navigate the complexities of government assistance programs and access the support they need to improve their housing and financial well-being.

Questions and Answers

Can food stamp benefits disqualify me from Section 8?

No, food stamp benefits generally do not disqualify individuals from Section 8 eligibility.

Are there any exceptions to the rule that food stamps are not counted as income for Section 8?

Yes, in some cases, a portion of food stamp benefits may be counted as income, such as when an individual receives Supplemental Security Income (SSI) or has a high income from other sources.

How can I maximize my Section 8 eligibility while receiving food stamps?

To maximize Section 8 eligibility while receiving food stamps, it is important to report all sources of income accurately and explore options for reducing other sources of income, such as earned income or unearned income from investments.