In-Home Supportive Services (IHSS) is a program that provides assistance to individuals who need help with daily tasks due to disability or age. But does IHSS count as income when it comes to determining eligibility for food stamps? Understanding the income classification of IHSS is crucial for maximizing your benefits and ensuring access to essential nutrition assistance.

This comprehensive guide will delve into the intricacies of IHSS income classification, its impact on food stamp eligibility, and the reporting requirements involved. We’ll also address common FAQs to provide clarity on this important topic.

IHSS Definition and Eligibility

In-Home Supportive Services (IHSS) is a government-funded program that provides assistance to individuals who are unable to perform daily tasks due to disability, illness, or aging.

To be eligible for IHSS, individuals must meet certain criteria, including:

Income Eligibility

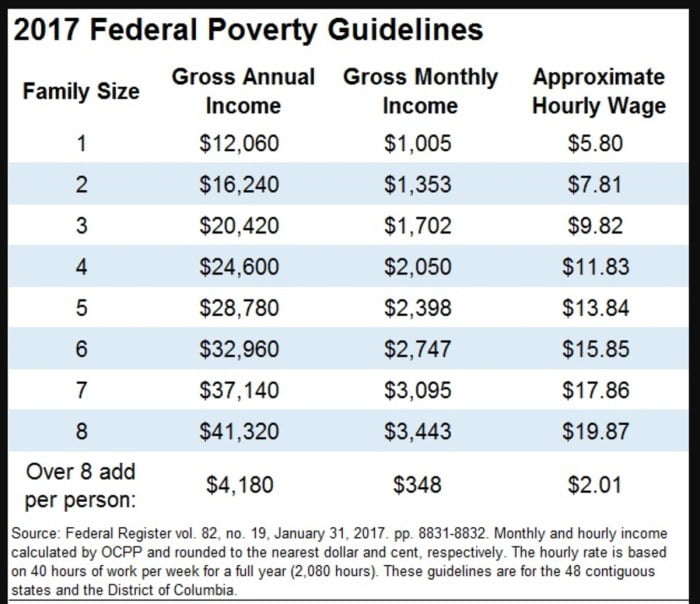

- Meet the income and resource limits set by the state.

- Have limited income and assets.

Disability or Age Requirements

- Be 65 years of age or older.

- Be blind or have a disability that prevents them from performing daily tasks.

- Need assistance with activities of daily living, such as bathing, dressing, or eating.

IHSS Income Classification

IHSS (In-Home Supportive Services) income classification is crucial when determining eligibility for food stamps. Understanding the specific guidelines and regulations is essential for individuals seeking assistance.

IHSS Income for Food Stamps

According to the United States Department of Agriculture (USDA), IHSS income is not considered income for the purpose of determining eligibility for the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps. This is because IHSS payments are intended to cover the costs of providing care to eligible individuals, rather than being a form of financial support.Therefore,

IHSS recipients can receive food stamps without having their IHSS income counted against them. This ensures that individuals receiving essential care services can still access necessary food assistance programs.

Impact on Food Stamp Benefits

IHSS income can impact eligibility for food stamps in several ways.

First, IHSS income is counted as income when determining food stamp eligibility. This means that the amount of IHSS income you receive will affect the amount of food stamps you are eligible to receive.

Second, IHSS income can affect your eligibility for certain food stamp deductions. For example, if you are elderly or disabled, you may be eligible for a deduction from your income when determining your food stamp eligibility. However, this deduction is only available if your IHSS income is below a certain amount.

In addition to affecting eligibility, IHSS income can also affect the amount of food stamps you receive. The amount of food stamps you receive is based on your household size and income. If your IHSS income increases, your household income will also increase.

This could lead to a decrease in the amount of food stamps you receive.

Reporting Requirements

To ensure accurate and up-to-date information, individuals receiving IHSS income must adhere to specific reporting requirements when applying for food stamps.

Frequency and Methods of Reporting

Reporting IHSS income for food stamps typically follows these guidelines:

- Initial Application: IHSS income must be disclosed during the initial food stamp application process.

- Periodic Reviews: Individuals may be required to provide updates on their IHSS income during scheduled food stamp recertification reviews.

- Changes in Income: Any changes to IHSS income, such as an increase or decrease, must be reported promptly to the food stamp agency.

Reporting methods may vary depending on the local food stamp agency. Common options include:

- In-person at a local food stamp office

- Over the phone

- Through a secure online portal

Summary

In summary, IHSS income has a direct impact on food stamp eligibility. While it is generally considered income, there may be exceptions or special circumstances where it may not count. Accurate reporting of IHSS income is essential to ensure proper determination of food stamp benefits.

By understanding the nuances of this topic, individuals can navigate the application process effectively and access the support they need.

Common Queries

Does IHSS income affect the amount of food stamps I receive?

Yes, IHSS income is considered countable income and can affect the amount of food stamps you receive. Higher IHSS income may result in lower food stamp benefits.

What if I receive IHSS and Social Security benefits?

Social Security benefits are not considered income for food stamps. However, IHSS income is still counted and can affect your eligibility and benefit amount.

How often do I need to report IHSS income changes?

You must report any changes in IHSS income within 10 days of the change. This can be done through your local social services office or online.

Can I appeal if my IHSS income is counted incorrectly?

Yes, you have the right to appeal if you believe your IHSS income was counted incorrectly. Contact your local social services office for more information on the appeal process.